NFT Management System

NFT Token Management Systems and Software offer a wide range of benefits for businesses, including secure wallet integration, cloud-based management, content distribution, and more.

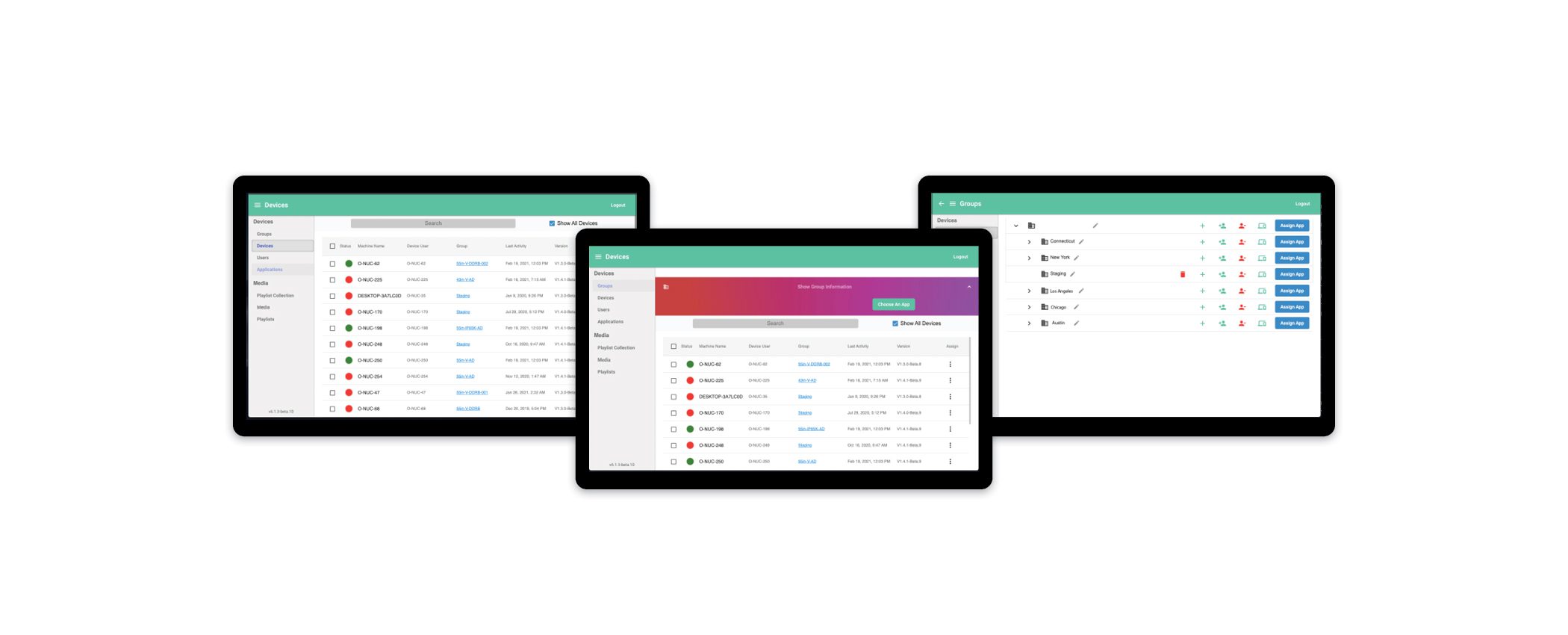

MetroClick’s NFT Portfolio Assets Management Software and Platform

MetroClick’s Token Management Software (TMS) offers asset owners seamless and secure B2C / B2B wallet integration for cloud-based management and distribution.

The MetroClick TMS Token Manager Includes

Secure Wallet Integration

Asset Carousel / Playlist Management

Peripheral Integration (e.g. camera, stylus, etc.)

Device Health (Monitoring)

Social Media Integration

3rd Party API Integration

Conditional Programming (e.g. weather, day of week, etc.)

Contact Us

for Solutions

Have questions? Interested in a quote or RFP? Contact us today and one of our specialists will follow up ASAP!

California

804 Anacapa Street

Santa Barbara, CA 93101

Florida

7630 NW 25th ST

Suite 2A

Miami, FL 33122

Metroclick Offices

T: 646-843-0888

New York

239 West 29th Street

Ground Floor

New York City, NY 10001

More Information

How NFT Assets and Portfolio Management Systems (TMS) can benefit your business

The MetroClick NFT Token Management System (TMS) offers seamless and secure B2C / B2B wallet integration for cloud-based management and distribution of digital assets.

The TMS helps to manage assets quickly and securely with a minimal amount of hassle. The system is designed to provide a user-friendly experience for those looking to manage their digital assets.

The TMS is the perfect tool for anyone looking to securely and easily distribute their tokens or digital assets.

What is an NFT Assets Management System (TMS)?

The NFT Token Management System (TMS) is a web-based application that enables businesses to manage their NFT tokens. It provides a user-friendly interface for creating, issuing, transferring, and redeeming tokens. The TMS also includes a built-in exchange that allows businesses to trade tokens with each other.

Why use the NFT Portfolio Management System?

The NFT Token Management System is the perfect solution for businesses that want to issue and manage their own NFT tokens. It provides a user-friendly interface for creating, issuing, transferring, and redeeming tokens. The TMS also includes a built-in exchange that allows businesses to trade tokens with each other.

How does an NFT Token Management System (TMS) work?

The NFT Token Management System (TMS) is a web-based application that allows businesses to create and manage their own unique, branded tokens. These tokens can be used to reward customers, employees, and partners.

The TMS is easy to use. Businesses can create tokens in minutes using the TMS web-based interface. Tokens can be distributed to customers, employees, and partners using QR codes or a manual redemption process.

The TMS also includes a token analytics module that allows businesses to track the usage of their tokens. This module provides detailed information on how many tokens have been issued, how many have been redeemed, and where they have been redeemed.

Why should businesses use the NFT Token Management

What are the benefits of using the NFT Token Management System (TMS)? The NFT Token Management System (TMS) is an innovative solution that offers a variety of benefits for businesses.

Some of the key benefits of using the TMS include:

- Increased security: The TMS provides enhanced security for your tokens, which helps to protect them from theft and fraud.

- Increased efficiency: The TMS makes it easier and faster to manage your tokens, which helps to improve overall efficiency.

- Reduced costs: The TMS can help to reduce costs associated with managing tokens.

- Seamless integration: The TMS is fully integrated with the NFT blockchain, making it easy to use and ensuring compatibility with all NFT applications.

What are the important features of an NFT Token Management System (TMS)?

An NFT Token Management System (TMS) is a web-based application that allows businesses to manage their non-fungible tokens (NFTs). It has a user-friendly interface that makes it easy to create and manage NFTs. The TMS also has a built-in exchange that allows businesses to trade NFTs.

The TMS has several features that can benefit businesses. These features include:

- The ability to create and manage NFTs

- The ability to trade NFTs on a built-in exchange

- The ability to view transaction history

- The ability to add or remove escrow holders

The TMS can help businesses manage their NFTs more efficiently

How to set up the NFT Token Management System (TMS)?

The NFT Token Management System (TMS) is a web-based application that allows you to manage your non-fungible tokens (NFTs). It provides a way to create, issue, and manage your NFTs. The TMS also allows you to view and transfer your NFTs.

The NFT Token Management System (TMS) is a web-based application that allows you to manage your non-fungible tokens (NFTs). It provides a way to create, issue, and manage your NFTs. The TMS also allows you to view and transfer your NFTs.